May 2023 Election for Local Option Levy

The Polk County Fire District No.1 Board of Directors has voted unanimously to refer a local option levy, or operating levy, of $0.78 cents per $1,000 of taxable assessed value to the May 2023 ballot.

Learn more by clicking on the FAQ's below:

FAQ's:

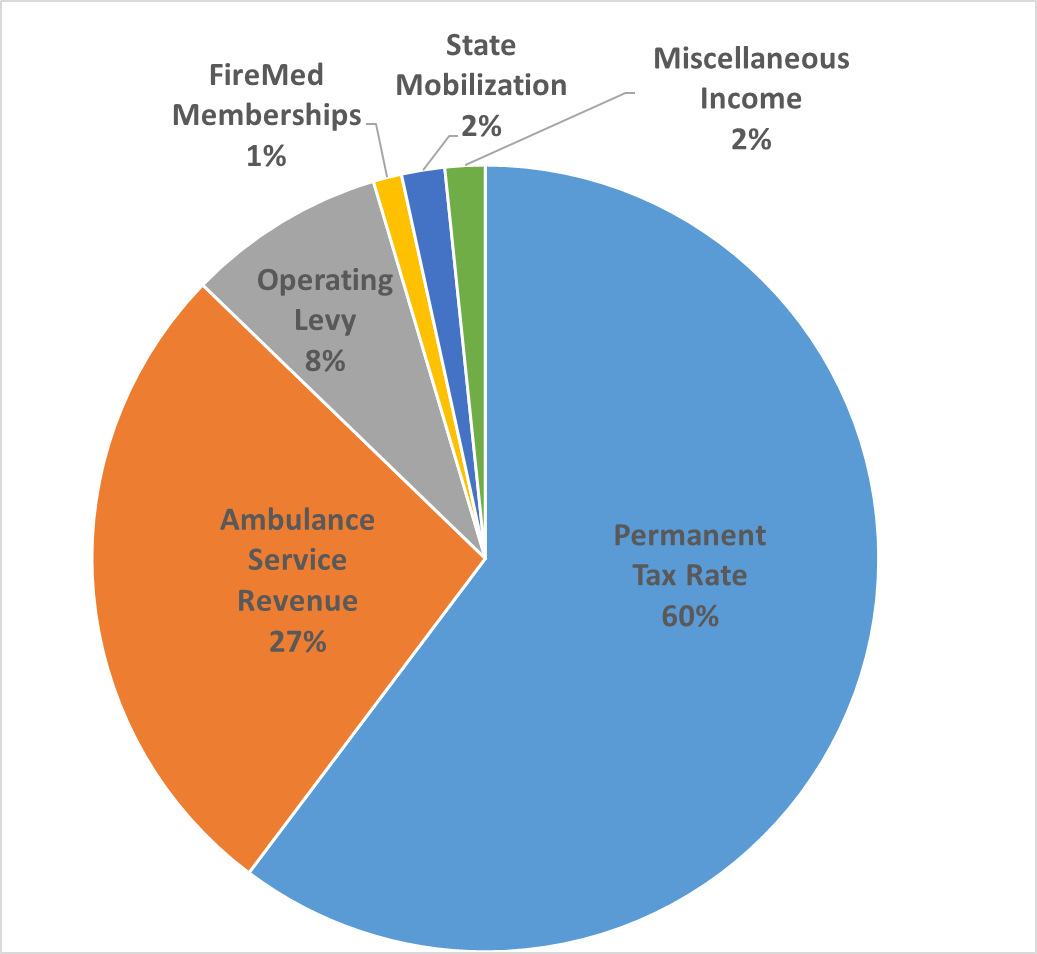

The District is very limited on the number of ways it can receive money. Outside of taxes, the only significant revenue comes from ambulance transports. Due to Oregon constitutional limitations, the District's permanent tax rate cannot be increased.

An operating levy is being pursued after the District became unable to meet ambulance response standards due to insufficient staffing to meet the increased demand. In the past two years, call volume has increased by 40%.

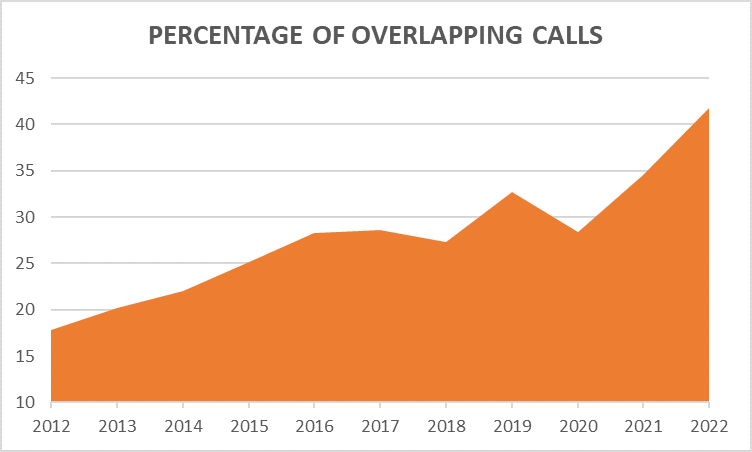

The increase in call volume has resulted in an increase in overlapping 911 calls.

While our 1st and 2nd staffed ambulances are able to meet response standards when they are available, when they are already on other 911 calls ambulances from other jurisdictions including Dallas, Salem, Keizer, and Albany respond to calls in our jurisdiction. This happened 359 times in 2022.

The operating levy is specifically aimed to support 911 response and does not increase administrative personnel. If the levy passes, the District will:

- Hire additional Firefighter/EMT's

- Fund seasonal firefighters

- Replace two ambulances

More detailed information below...

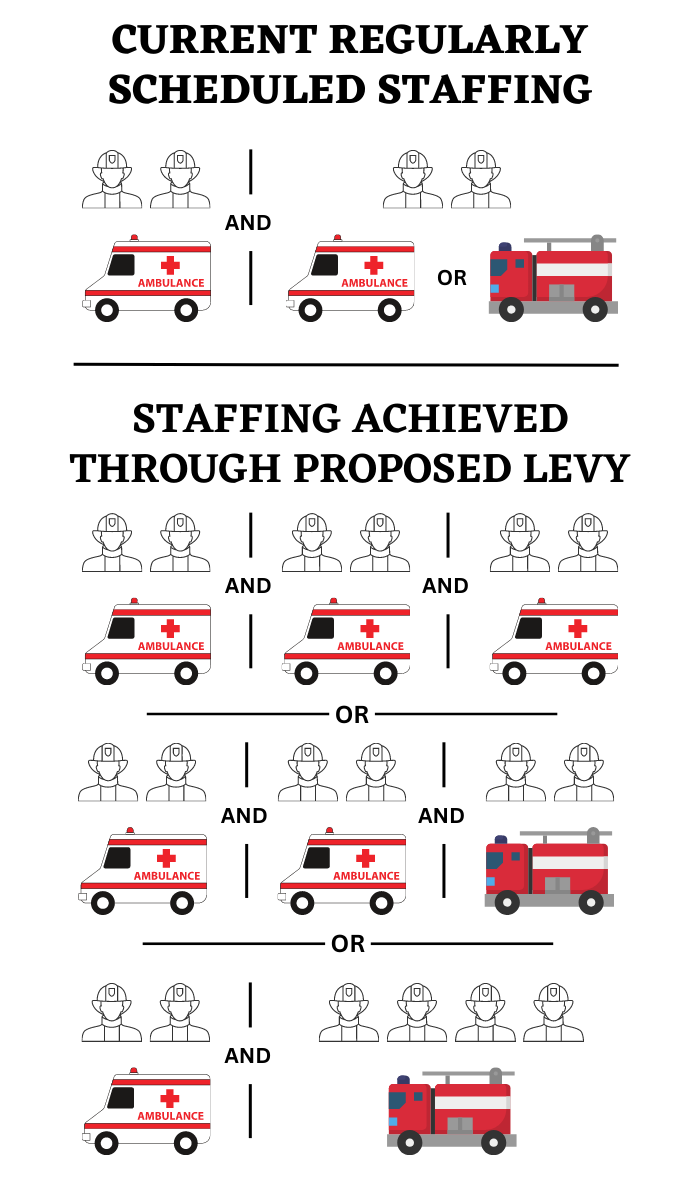

1. Hire additional Firefighter/EMT’s to staff an additional ambulance or fire engine 24 hours a day in order to meet response standards.

2. Fund seasonal daytime firefighters during the summer wildland fire season when call volume and fire impacts increase.

3. Fund the replacement of two ambulances that will reach the end of their service life during the 5-year levy.

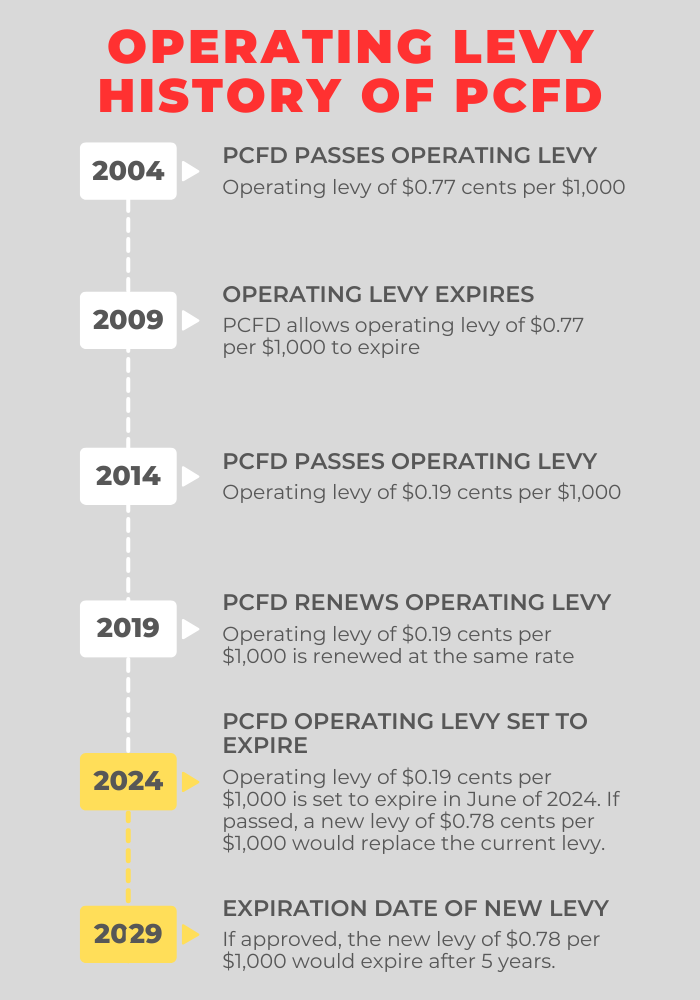

The District has passed the following levies:

- 2004: $0.77 cents (allowed to expire after 5 years)

- 2014: $0.19 cents

- 2019: $0.19 cents (renewal of previous 5 year levy at the same rate)

If passed, the current $0.19 cent levy would expire in June of 2024 and the new levy would take effect in July of 2024.

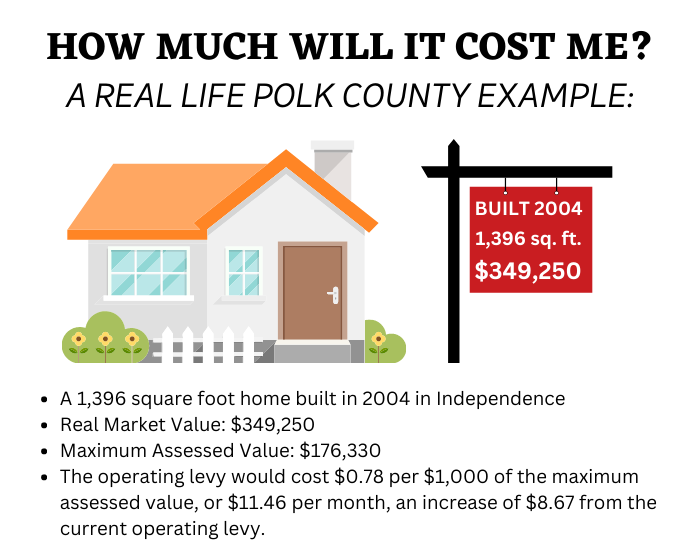

In Oregon, property taxes are based on the lower of a property's real market value, or maximum assessed value.

- Real market value (RMV) is the the price your property would sell for in a transaction between a willing buyer and seller on January 1st of the assessment year.

- Most property owners in our Fire District pay taxes based on the property's maximum assessed value (MAV). This is what the real market value of a property was in 1995, minus 10%, plus 3% per year. (For homes that were built after 1995, a calculation is used to compare RMV to MAV for similar homes in the area).

The total property taxes to all general government services cannot exceed $10.00 per $1,000 real market value and $5.00 per $1,000 for education.

To find the real market value and maximum assessed value of your property visit PCMAPS 5 by clicking here..

For more information on the property tax system visit the Polk County Assessor's website by clicking here.

The Fire District is intentionally going out for this operating levy a year before the current levy expires. This way, should the levy fail, the Board has time to make difficult decisions regarding the level of service that the District can provide given the level of funding that the community is willing to support.

There are, however, not only District response standards, but State and County Rules regarding response times for ambulances. If the District cannot fund its operations at a level that meet State and County requirements, the District may need to explore alternative ways to support emergency medical response within the District.

If you have any questions, please email info@polk1.org